September 2017

EM Systems (“EMS”) is the largest software provider for dispensing pharmacies in Japan. In many ways, EMS embodies qualities that we look for in a company: a franchise business that benefits from a highly sticky customer base and a solid capital allocation track record.

It is worth noting that EMS is very thinly covered by analysts and thus flies under the radar of larger institutional investors. However, Lacuna’s edge comes from finding these “gems” through our proprietary screening process by applying our entrepreneurial investment approach to less crowded markets. In the case of EMS, we leveraged our knowledge of Pharmagest and Cegedim in France and Compugroup in Germany to the Japanese healthcare services market.

From Epson to SaaS under Strong Leadership

EMS was founded in 1980 by its current CEO Mr. Kozo Kunimitsu who still runs the company. It started as a joint venture with Epson but in 1991 EMS created its own software, “Recepty Next”, which manages the administrative process for pharmacies, prepares invoices for insurance disbursement and provide records of patient history to pharmacies. This software is highly critical to pharmacies and not easily replaced. As a result, EMS has extremely loyal customers which can be seen in the < 4% churn rate.

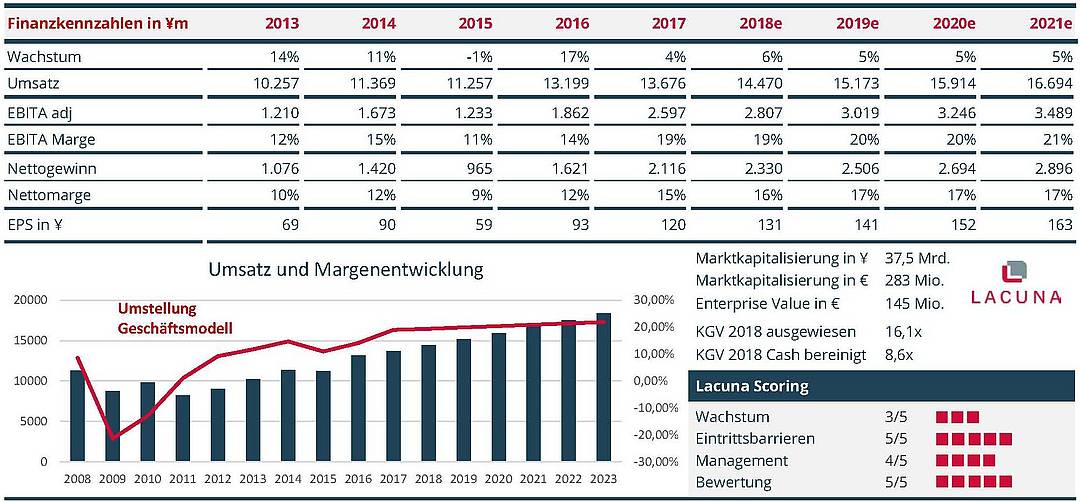

In 2009 EMS switched its business model from a license model to software as a service, run in EMS’ own datacenters. This transition away from a lumpy, contract-based business initially cost the company a significant part of its revenue; however, it significantly stabilized the business model with its high share of profitable recurring revenue stream. As investors we value this stability and low-risk profile.

Growing Market Leader with Top-Notch Product

Today, Recepty Next is used by 16.000 out of around 50.000 pharmacies in Japan, implying a >30% market share, which makes EMS the market leader. Over the last several years, EMS grew ca. 9% p.a. and took market shares from its main competitors due to its strong sales force and its cloud-based solution. For the future we assume a growth rate of ca. 5% with some smaller acquisitions.

With the support of the recent government measures to reduce the cost of healthcare and proliferation of electronic medical records, EMS believes that it can increase market share to 50% in several years. This is also fueled by the fact that the remaining 40% of the market is split among ca 100 smaller players, which could lead to further growth through consolidation in the market. In an industry that is so data- and scale-driven, this is a winner-takes-majority market, and we believe that winner will be EMS.

Good Management and Governance

EMS is an owner-run company. The founder and CEO, Mr. Kozo Kunimitsu, still owns 40% of the shares. As such, he has significant skin in the game and his interests are aligned with ours.

One characteristic we would like to see in a management team is that they think long term, not just from quarter to quarter. The migration to a software as a service business model as aforementioned, cost EMS significant short-term pain as revenues declined by 22% in 2009. However, this was the right decision in the long-term by increasing the switching cost of its clients and creating a subscription-based revenue stream with a long tail.

Another characteristic we look for is a strong capital allocation track record. In the face of the 2008/09 transformation, EMS’ shares dropped to an all-time low of around ¥160. In the following years, the management executed an aggressive share buyback program, which is extremely rare for a Japanese company. In addition, when EMS struck a symbiotic deal with Medipal, the top healthcare distributor in Japan, Medipal sought EMS stock at a 92% premium to the market price. All of this gives us confidence that EMS’ management will continue to make good decisions with our money.

Other smart money is invested as well, namely a top 5 shareholder VARECS Partners, which is affiliated with First Eagle, a reputable value investor with a long-term horizon and a strong track record.

Valuation with Downside Protection

Aside from the core pharmacy software business, a piece of prime real estate that the company has owned since 2005 has drawn our interest to EMS. The financing of the Shin-Osaka Brick Building is also a case study in financial savviness: EMS paid for the land in 2005 using debt and then issued shares at the peak in early 2006 to pay a chunk of that debt off.

Not only does the building provide us as investors with additional downside protection, but there is also the option that management could monetize the building, which would be a trigger to unlock value. Even after applying a rather conservative cap rate, we estimate that the value of this prime real estate near Osaka train station to be at least ¥13-14B.

Along with EMS’ net cash position, these hard assets make up ca 50% of the company’s current market value. This would mean that we are getting the core EMS business itself for around ¥1.040 per share on a stock trading at ¥2.125. This implies that Lacuna can buy the operating business for ca. 8,5x its sustainable earnings, which in our opinion, is a great bargain for a high-quality compounder with well-incentivized management and strong secular tailwinds.

Summary:

EM Systems embodies the core qualities that we look for in an investment. It offers above-GDP growth with a secular tailwind, a high-margin and robust business model with a highly loyal customer base, and a management team with a long-term vision. For all this, we can purchase the company at a meaningful discount and can deliver solid double-digit returns over the next 5 years.