October 2018

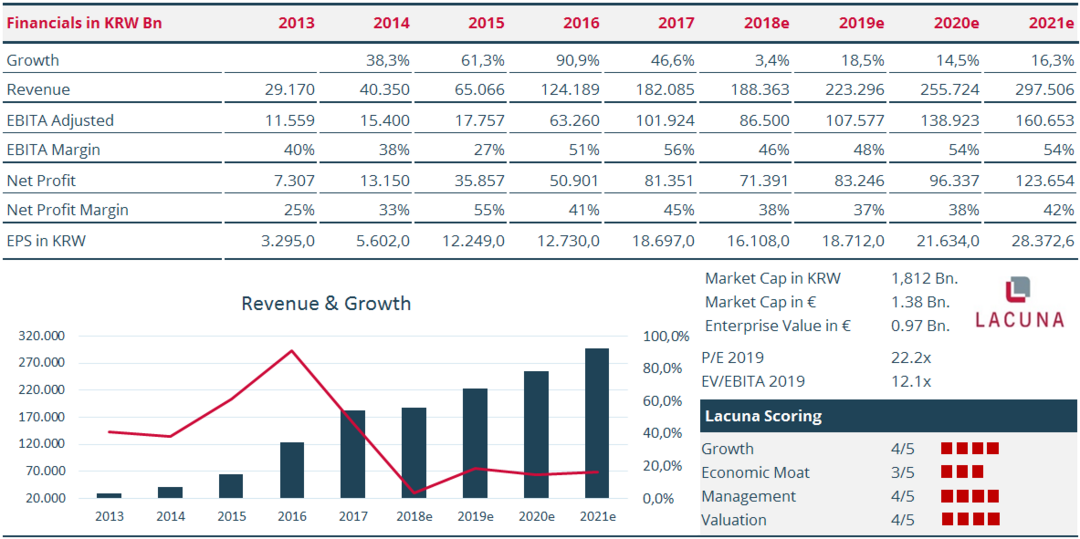

Hugel Inc (“Hugel”) is a large-cap South Korean cosmetics company selling Botulax (well known as “Botox”) and Dermal Filler in Korea (30% of total sales), and exports to countries such as Japan and Latin America. We are betting on a company that disrupted the Korean staid-old Botox industry and grew from 0% to 38% of the market over the last decade while still maintaining healthy margins. We expect Hugel to replicate this process and establish itself as a global brand.

The Contender

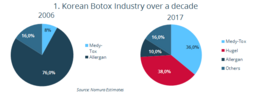

Hugel is one of the few Korean companies that have been leading a wave of disruption in the cosmetic surgery landscape. Over the last decade, the Botox industry landscape in Korea has altered completely. Incumbents such as Medytox and Allergan (which accounted for >90% of the market in 2006) gave up market share to new entrants such as Hugel (38% of the market in 2017). (Chart 1)

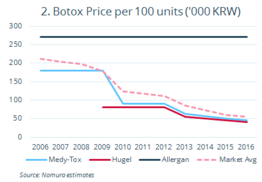

Hugel disrupted the Botox industry in the same way that discounted airlines disrupted the business model of full-service carriers by focusing on reducing prices. Just like there is no product differentiation in the airline travel industry, there is no difference between one Botox product and another. Hugel capitalized on its economies of scale and slashed the Average Selling Price (“ASP”) of Botox.

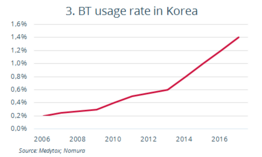

The impact of reduction in prices can be seen from chart 2 and 3, which show that Hugel entered the market in 2009 at a price 2/3rd of prevailing Botox procedures, forcing Botox prices to converge to what Hugel charged. This was followed by a nine-fold increase in Botox usage driven by increased awareness among Koreans about Botox and its substantial price reduction.

Skin and Bones

Since the beginning of 2018, Hugel’s share price has corrected by ca. 25% driven by short term issues from the slow offtake in Chinese sales. The Street overestimated the impact of the slowdown in China, which accounts for an estimated 20% of sales, and ignored the long-term prospects. The catalysts that will increase the intrinsic value of the company are:

- change in majority ownership (Bain and Morgan Stanley acquired over 50% stake in the business)

- growth prospects in other markets (such as USA, EU, and Asia)

- and a strong balance sheet (cash accounts for 30% of market capitalization).

This gives us enough reasons to invest in this business.

This disruptive company driven by a strong management team expects to grow sales by 12% CAGR over the next five years, generate Return on Capital Employed of over 15%, and is available for 12.5x EV/EBIT (2019) and P/E of 22.7x (2019) which offers a good entry point.

Breakout

We think the “Theory of Disruptive Innovation” as propagated by Clayton Christensen will hold true. The theory describes a process by which a product or service takes root initially in simple applications at the bottom of a market and then relentlessly moves up-market, eventually displacing established competitors.

We believe Hugel will be able to repeat what it did in Korean Botox markets in the US market, which is currently an oligopoly, as well.

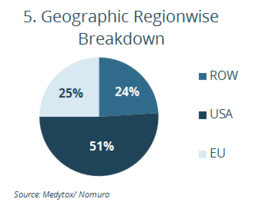

The global Botox market has been growing at a CAGR of 12% p.a. and is estimated to touch $4 bn with more than 50% of that demand from the US followed by EU at 25%. We expect the growth to pick up pace over the next two to three years as disrupters such as Hugel make Botox more accessible to the masses (Chart 4 + 5). Botox marketed by Allergan is the biggest brand, accounting for 76% of the global Botox market, followed by the French brand Dysport (15%).

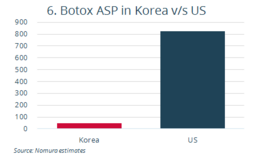

Botox’s ASP in the US has increased from $694 in FY16 to $824 per 100 units in September 2017, while in Korea, Botox’s ASP is just $50/100 units. The only reason incumbents can charge such high prices is the brand. We believe that these supernormal profits will be dented with the introduction of low cost competitors such as Hugel (Chart 6).

We think that when Hugel obtains its FDA approval (expected by 2020/2021) to market Botox in the US, it will have a dual impact:

- Pricing: bring down prices substantially for existing customers

- Volumes: increase the market size by bringing in new customers who could not afford a Botox surgery, thus increasing penetration levels.

Our view is that cost leaders such as Hugel will benefit from these two trends.

Have it All

In 2017, a consortium of private equity funds (Bain and Morgan Stanley) took a controlling stake in Hugel’s parent company. The operating style of the company will change as it shifts focus from local to global markets. Additionally, Bain has had a history of successful exits in its healthcare investments.

The new owners have infused additional cash into the company to help build the business in new geographies and restructured the corporate entity; additionally, the senior management team has been prioritizing the company’s US entry strategy.

We believe that the business (and its shareholders) will benefit from the renewed focus.

Big in China

Hugel does not have a direct presence in China, but Hugel’s domestic distributors buy its product in the domestic market and supply it in China. Over the last two quarters, the stock price of the company (and other domestic Botox suppliers such as Medytox) has corrected by ca. 25% on news of clampdown of Botox imports by the Chinese FDA. We estimate that indirect exports to China account for roughly 25% of the total revenues of the company.

Based on our conversations with the management, we view this as a temporary issue that will be fixed over time, and the current market price of the stock already reflects the slowdown in the Chinese market. Furthermore, the company is also in the process of obtaining an approval for Botox from the Chinese FDA (which is expected by December 2019), which would enable it to distribute its products directly in China.

Summary

We believe in the business for the following reasons:

- Hugel’s plans to replicate its success in the Korean market and launch in US by bringing down the price of Botox procedures. Hugel will not only disrupt the Botox market for incumbents such as Allergan, but also increase the demand for Botox.

- Private equity firms that have taken control of the company have a stellar reputation of building world class businesses. We believe that the majority stakeholders’ interests are aligned with the equity shareholders.

- We think that the issues in China are short-term and will reverse over time. The market has already accounted for the impact of China on the company’s operations in its price, and it does not impair the long-term value of the company.