June 2018

Sinopharm is China’s largest pharmaceutical distributor with the country’s most extensive pharmaceutical distribution network. As the industry shifts from a fragmented to a more oligopolistic competitive landscape, the company has been the primary winner of the trend with its market share more than doubling in a decade. We believe that Sinopharm will continue to benefit from this trend as the new two-invoice system in China squeezes out smaller to mid-level distributors.

A Government-Sponsored Market Leader

In January 2003, Sinopharm was established as a joint venture involving China National Pharmaceutical Group Corp (CNPGC), a medical and healthcare State-Owned Enterprise (SOE). Today, CNPGC continues to own a 57% stake in the business.

In Western markets, we often shy away from state-owned companies, mainly because of a lack of performance-culture. However, in China being a state owned enterprise often comes with advantages.

Sinopharm has been (and will continue to be) the primary beneficiary of government tailwinds in the industry. Since 2009, the Chinese government has pushed through regulation cutting the layers of distributions from pharmaceutical companies to hospitals, even going so far as to mandate that the top 3 national distributors must have at least Rmb 100B in sales.

As such, Sinopharm’s market share has progressed as follows:

| 2006 | 2011 | 2016 | |

| Market Share | 7% | 11% | 17% |

The three largest distributors currently account for close to 30% of total industry revenue, with Sinopharm alone making up almost 20%. We expect that Sinoparm can continue to gain market share in the future.

Scale is King

In an industry where margins are as razor-thin as in drug distribution, scale is the key barrier to entry: Sinoparm’s distribution network has been built over many years and would be extremely difficult to match for a new entrant or even other major competitors. Sinopharm has the broadest geographic coverage in the industry, reaching 95% of Tier 1 hospitals and 75% of all hospitals in China. This hospital penetration is the highest among its competitors and is >30% higher than that of the #2 player, Shanghai Pharma.

The financials reflect this in 2 main ways:

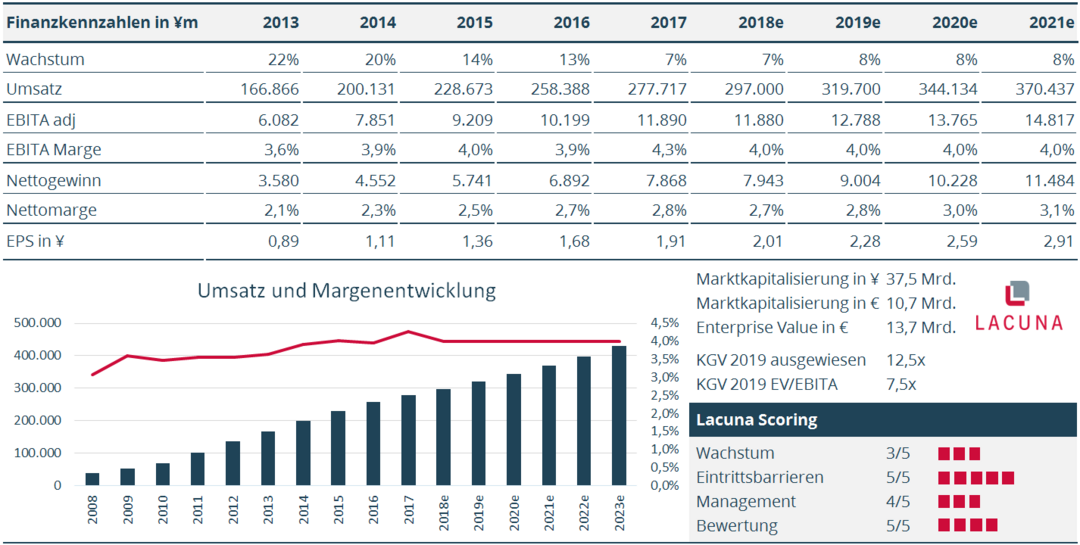

- With such high fixed costs, the company has benefitted from operating leverage over the years as EBIT margins increased from 2% in 2006 to 4,3% in 2017.

- Because of the higher margins, Sinopharm also enjoys a higher sustainable return on total capital employed at 17% versus Shanghai Pharma’s 10%.

Additionally, Sinopharm’s scale gives it a positive “flywheel” effect: as the largest player, it can also offer the widest range of products. In fact, it carries more products than four of its largest competitors combined (Shanghai Pharma, Jointown, Nanjing Pharma, and Guangzhou Pharma).

Such a diversified offering allows Sinopharm to become a one-stop shop for customers and achieve leverage in government tenders and hospital drug purchases. Furthermore, its enables Sinopharm to adjust its product mix to mitigate pricing pressure tied to any individual drug.

Industry Shake-Up Presents Buying Opportunity

The main shake-up in the industry comes from the implementation of the new Two-Invoice System. In January 2017, eight Chinese ministries announced a significant new policy that aims to reduce mark-up prices and corruption in multi-tier distribution chairs. Basically, the policy requires that under most circumstances, a maximum of 2 invoices may be issued throughout the supply chain:

- Manufacturer to Distributor, and

- Distributor to Hospital

This would directly impact about 35% of Sinopharm’s sales that are to national and provincial sub-distributors. Indirectly, the policy would tie up more of the company’s cash through a larger account receivable balance, since hospitals take longer to pay their distributors.

Such a sweeping regulatory change has caused shares to fall to ca HKD 35 after a run-up to HKD 44 on strong fiscal year 2017 results released in early April 2018. However, we strongly believe this shake-up is not only temporary, but will in fact be a major positive for Sinopharm in the long-term as the smaller scale players will get washed out of the industry.

Summary

While we are up ca 13% on the position as of May 30th, 2018 from our initial purchase price, we believe that there is still significant upside in the stock:

- As the Chinese government further eliminates extra layers of distributors in the pharmaceutical supply chain through the two-invoice policy, Sinopharm will further cement itself as the market leader in the industry. The policy will further flush out the sub-scale and financially weak distributors, which would also provide Sinopharm with good acquisition opportunities.

- While there has already been a push towards industry consolidation, the Chinese distributors’ oligopoly is still far behind that of their global counterparts. In the U.S., the top 3 make up 90% of the market, in Europe 70%, and in Japan 75-80%.

In summary, Sinopharm is the market leader in a stable and well-protected market. Current industry trends give the company a tailwind over the next years. We see great long-term performance as pharma distribution have nowhere to go and will still be an irreplaceable business for many years to come. We will happily stay invested, as we believe that a valuation of ca 14x net profit 2018 does not reflect the stability and growth potential of the company.