January 2020

Granules is a manufacturer of high-volume generic pharma APIs and formulations, which are sold globally. It has large manufacturing facilities for core molecules like Paracetamol, Metformin, Ibuprofen and others.

An improving business mix, better pricing and rising capacity utilization will enable Granules to continue the 20% growth trajectory, which it witnessed over the last 3 years.

We met the CEO, Mr Chigurupati, in late 2017 and were impressed by how a first-generation entrepreneur built a small-scale API business into a large formulations business. We conducted in-depth research on the business and decided to invest in early 2018.

Our investment thesis revolved around: i) a turnaround expected in earnings following the conclusion of the capex phase (by FY19); ii) the rock-bottom valuations which the business was available at did not represent the intrinsic value; iii) our interactions with the management team and their past execution history gave us conviction on their execution capability.

Further, interest among institutional investors is generally limited for small cap businesses which have less sell side coverage. Our research backed our conviction on the company.

The three key factors that caught our attention were:

1. Completion of the capex cycle leading to earnings growth

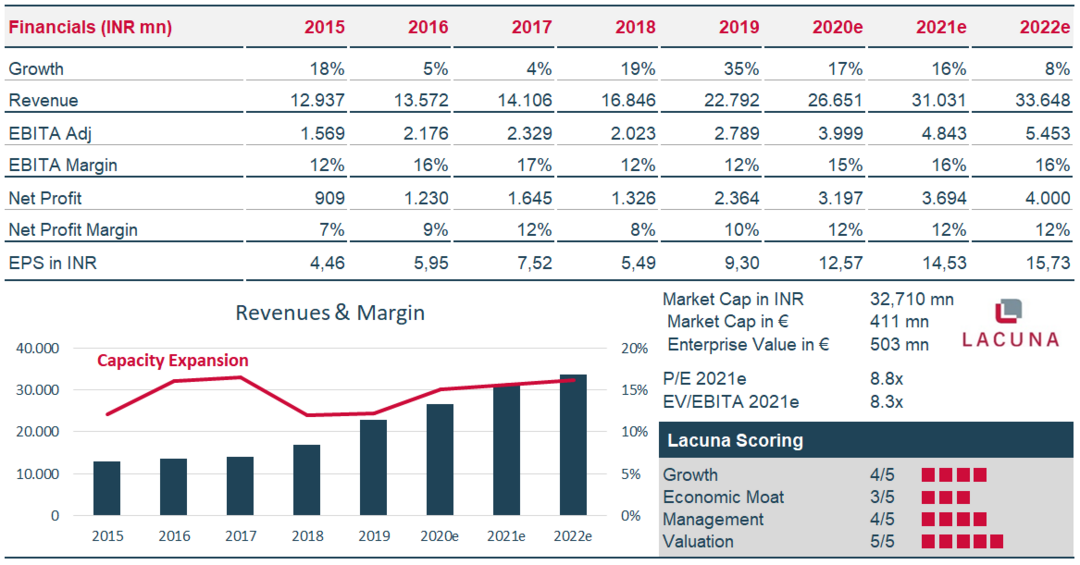

Granules invested INR 10.5bn (representing 70% of its fixed assets) over the last 3 years in expanding its manufacturing facilities and now has one of the largest API capacities globally. Granules was able to focus on higher margin businesses (i.e. US formulations segment). With increased utilization and a better business mix, EPS jumped 70% YoY to INR 9.28 in FY19.

The company’s fixed assets remain under-utilized, with an asset-turnover of 1.5x which is expected to improve to 2.4x by FY22E. This will drive revenue growth of 14% without any additional capex. Operating leverage will improve profitability by 100bps annually and drive a 19% growth in net earnings. We estimate that Granules will generate over INR 3bn of Free Cash Flow annually for the next three years. The stock currently trades at 10x free cash flow and 10.2x earnings on trailing financials, which is a significant discount to its peers.

With business delivering operational performance, we believe it is only a matter of time for multiples to re-rate.

2. Salience in the business – One of the key factors driving the success of Granules is its relationship with clients

> Scale: Granules has a presence in over 75 countries and serves more than 300 global customers. It also has a robust pool of 36 Abbreviated New Drug Applications (ANDAs) (14 of which are approved).

> A diverse range of offerings: Granules is among the few pharma companies offering a fully integrated basket of products – ranging from APIs to Pharmaceutical Formulation Intermediates (PFIs) and Finished Dosage Forms (FDFs). Moreover, its capabilities extend beyond plain-vanilla oral solids and include a variety of dosage forms including rapid-release caplets and bi-layer tablets.

> Strong technical and operating expertise: Its R&D team is focused on commercializing new products across complex forms, while its operations team aims to develop process efficiencies and improvements.

> A winning mix of price and quality: Granules provides price-competitive products while adhering to the highest quality standards globally. Its strong commitment to quality compliance is testified by its largely clean track record of US Food and Drug Administration (FDA) inspections. It has 4 plants in India which are all US FDA approved. It also has a facility in the US.

3. First-generation entrepreneur

Mr Chigurupati co-founded Granules with his wife and transformed the business into a fully integrated pharmaceutical business after succeeding in becoming one of the largest manufacturers of Paracetamol APIs.

The founders own 43% of the business and are focused on growing the business. While the promoters have brought in external professionals to help run the business the second-generation of the founder also works with some parts of the business.

The team’s passion, hard work, and dedication towards the business are what gave us conviction in their ability to execute the turnaround in earnings. Apart from Granules, the Chigurupatis are famous for their participation in several marathons and have even made it to the Guinness Book of World Records.

Headwinds

As much as we hope, businesses do not operate in a linear fashion. While the street closely adjusted every uptick and downtick in their financial models, we looked for fundamental changes in the business. In our view Granules largely performed in-line with our expectations (and the management’s guidance) since we invested. However, some of the key events which affected the company over the last two years were:

Raw material price hikes: Following environmental issues in China, the entire industry faced supply issues and escalated prices in raw materials. This also impacted Granules, which lost 500bps at its gross margin level in FY18.

Our view was that this was a cyclical phenomenon that we expected to reverse, and it did not change our investment thesis.

Promoter pledge: The promoters, in their attempt to grow the business, undertook personal debt to invest in the capacity expansion at Granules. This led to the creation of a pledge on their personal holdings in the company.

This was a time when the other Indian businesses were also taking out pledge on their stock to fund promoters’ other ventures which had the street worried. They categorized Granules’ situation as such and threw out the “baby with the bathwater”. The stock price was punished regularly. The promoters recognized this as an issue and addressed the concern by deciding to extinguish their entire pledge by the next fiscal year-end. As of date, they have already extinguished 50% of the pledge.

While the promoter pledge did make marquee investors uncomfortable, we treated it as more “noise”. We understood the rationale behind the management’s decision and stuck to our investment thesis.

Leverage: Despite excellent operating performance during the previous year, Granules’ net debt grew by 7% year on year (as against our expectation of debt reduction).

We understood that the previous year’s performance was impacted by cyclical issues which drained operating cashflows. While we would have liked to see some reduction in the debt levels during the previous year, we are happy to see it happen in FY20, with the net debt already down by 20% during the first half of FY20.

Summary

We believe that Granules’ future business will be aided by large-scale manufacturing capacities in 8 core molecules and a healthy rate of filings for new molecules. ROC’s (Return on Capital) at 7.3% are suppressed due to under-utilized capacities. An increase in capacity utilization will improve operating performance and increase ROC’s. The management aims to achieve 20% ROC and 1.5x Net Debt / EBITDA by FY22.

Our view is that the company has a long runway to grow supported by increased utilization and commissioning of a new block for oncology molecules. Granules’ revenues grew by 20% CAGR over the last 3 years while the stock has yielded returns of 21% (V/s -9% for the comparable index). We feel at current valuations of 8.3x EV/EBIT 2021 and 8.8x P/E 2021 the business is undervalued.