February 2018

Sirtex Medical Limited (“Sirtex” or “the company”), is an Australian medical devices business which provides radioactive treatment for inoperable liver cancer patients. Once a darling of the market, its share price has halved over the last fifteen months due to a mix of internal and external factors. Our assessment is that the company’s underlying business is still intact, and that the market overreacted to negative news.

Dominant Market Position

Sirtex was founded in 1997 and received approval from FDA in 2000 for its medical device that administers Selective Internal Radiation Therapy (“SIRT”)ᶧ on salvage patients*. Soon, the company realized that a simple FDA approval wasn’t enough for oncologists to prescribe a SIRT procedure. As such, Sirtex spent the next 17 years conducting clinical trials and building a body of evidence to gain approval from oncologists. As a result, Sirtex’s revenues grew at a CAGR of 23% since 2002.

Sirtex caters to a niche market of 180k patients with most of its revenues from the US market where it has a duopoly with a 40% market share. Globally, it has a 60% market share. Our assessment is that the company has a strong moat around its medical product, a FDA certified Class III PMA (Pre-market Approval) device.

Lead time for a competitor to get an approval from the FDA for such a device is minimum 3-4 years. Further, a new competitor would take at least 5-6 years and numerous clinical trials to gain reasonable traction from oncologists. Given the small market size the market is relatively unattractive for larger players to enter. These factors most likely will protect Sirtex’s business prospects for a very long time.

The Opportunity

One of the frameworks we usually employ is the “Wounded Eagle” framework. We identify high quality businesses which are going through a rough patch, even though their long-term prospects are not at all impaired. Markets tend to focus on the short-term performance of these businesses and often throw out the baby with the bathwater.

When the stock price more than halved over the last 2 years, we saw it as a buying opportunity. Sirtex’s shares were punished due to a combination of the following factors:

- Sirtex announced that some of its large clinical trials failed to achieve their end objectives, which raised questions on the company’s growth prospects.

- Sirtex took a write-off of A$90 mn and registered its first annual loss in over a decade.

- The former CEO was being investigated on allegations of insider trading.

- The company was losing market share due to competition from substitutable treatments. Volume growth from the US was just +4.5% during the preceding year compared to +23% CAGR over the last five years.

We conducted diligence on each of those points that ultimately led us to conclude that the core moat of the business was not impaired and that the barriers to enter the market were still intact.

Soaring High with a New Strategy

The Board appointed a new CEO in June 2017. As part of our diligence process, we interacted with the company and were impressed by the initiatives Sirtex was taking to turn around the business:

- Sirtex was able to increase cash flows by focusing on small trials instead of undertaking large trials.

- There was a greater focus on profitability as the management was committed in reducing overheads.

- The company concentrated on growth by entering new regions (such as Japan and China) and building sales force efficiencies in the US to tackle competition.

Most of all, we liked the fact that the new management had made changes based on lessons from its earlier experiences. We closely monitored the results and found that management initiatives were yielding results when the Company guided to a recovery in earnings growth for H1 2018.

Other aspects that we look for is how the management is remunerated and whether its incentives are aligned to the interests of the shareholders. At Sirtex, the Base Salary is benchmarked to the standard industry compensation while annual bonuses were based on a mix of operational KPI’s. The management’s long-term incentives are awarded in the form of stock options which tied the fortunes of management to that of the shareholders.

Margin of Safety

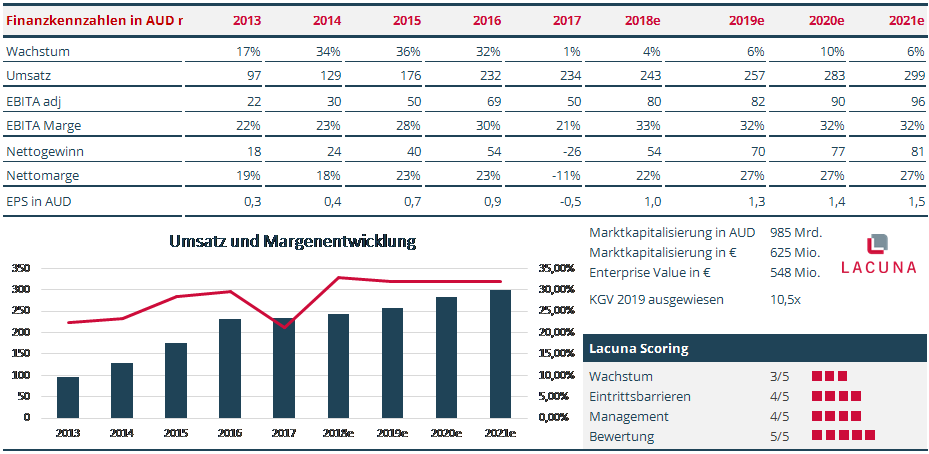

Even though the clinical trials failed, our opinion was that the underlying business is still quite stable with annual sales of A$240 mn in 2017. Given the market size, we projected organic volumes to grow by 1-2% with price increases of 2-3%. The company had great operating margins of 25%.

Additionally, Sirtex’s business model does not need a lot of investment in the business which means that the company is able to generate significant amounts of free cash flow. This supports its strong balance sheet with a cash balance of over A$100 mn, as well as a strong ROE of ca 27%. Management was quite judicious about its capital allocation policy and had announced a dividend + share buyback generating a yield of 5%.

Due to all this, we were able to buy Sirtex at a reasonable price of Forward 11x EV/EBITA.

Summary:

Sirtex fit all our investment criteria of a business with strong barriers to entry, run by a new and capable management team with a good capital allocation policy. Since we were of the opinion that the market overreacted over short-term concerns, this estimation gave us an opportunity to buy a good business at a reasonable valuation. For this reason, we started building a position in Sirtex in early 2018. However we apparently were not the only ones who liked the company and estimated it’s value above market prices: Varian Medical Systems announced an 100% all cash acquisition of Sirtex on February 1st, 2018.

This move came sooner than we expected but gave our position a decent +73% boost before we exited in early February as the acquisition price reflects what is in our eyes fair value.

*“Salvage patients”: cancer patients for whom chemotherapy or surgery has failed.

ᶧSelective Internal Radiation Therapy