Notice of restricted distribution licences for the Lacuna Eastern Europe Fund

Lacuna Eastern Europe is a product of Lacuna Investment-AG TGV. Lacuna GmbH is neither a provider nor authorised to distribute the fund.

Legal notice: The content of this website does not constitute an offer or an invitation to submit an offer to purchase units of Lacuna Eastern Europe. Lacuna Eastern Europe is only available to professional and semi-professional investors and is not publicly available.

If you have any questions, please contact your Lacuna Investment-AG TGV contact person. The information contained in this website is provided to you for explanatory purposes only. Lacuna GmbH only publishes product-related information and does not make any investment recommendations.

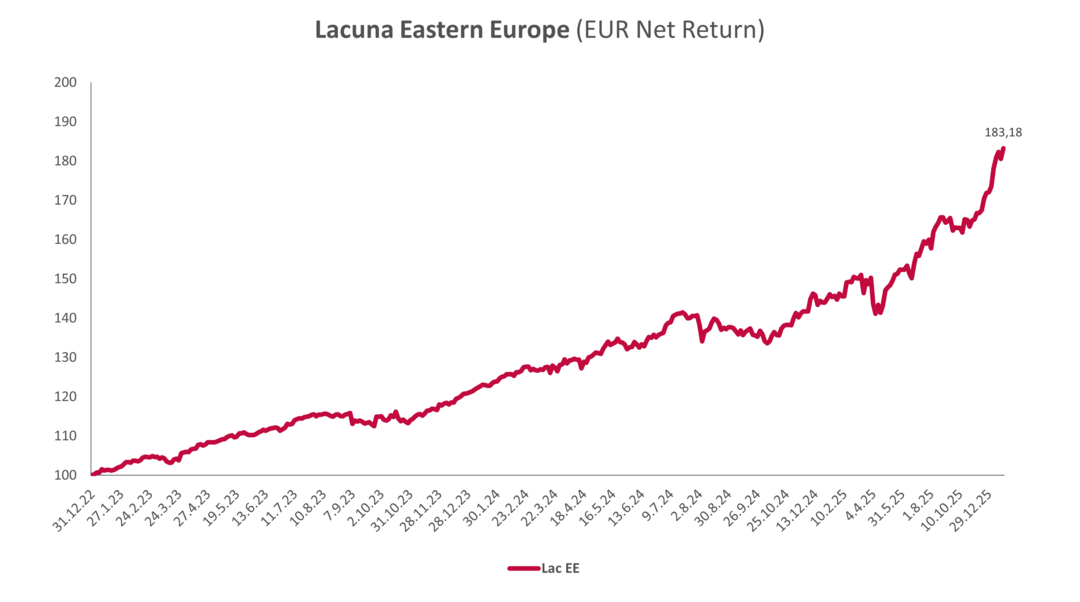

*Past performance is not a reliable indicator of future performance. The price performance shown does not take into account any costs incurred by the investor such as issue surcharge and fees for advice/distribution. Exchange rate fluctuations may affect the values of foreign investments.

Investment concept

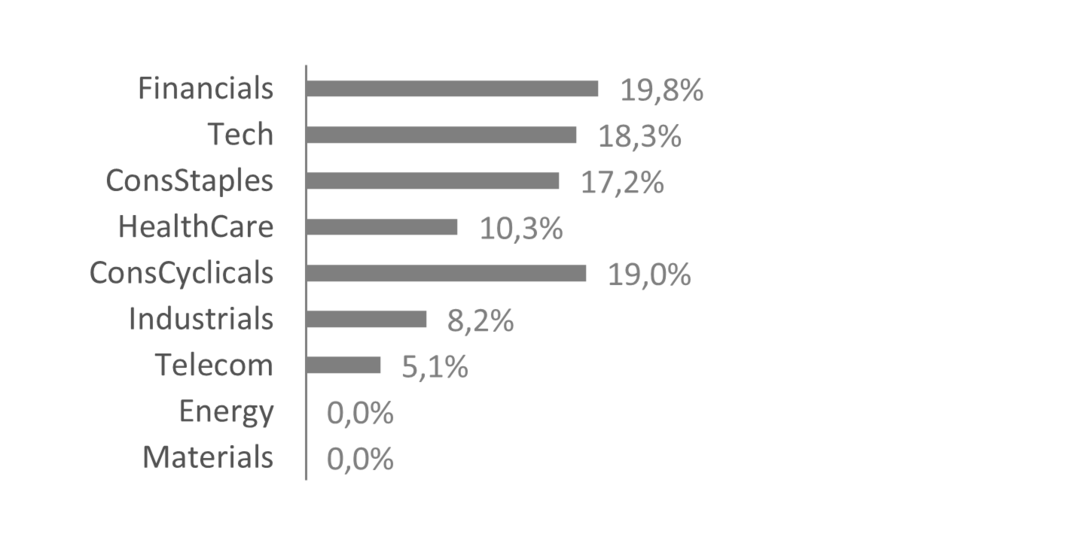

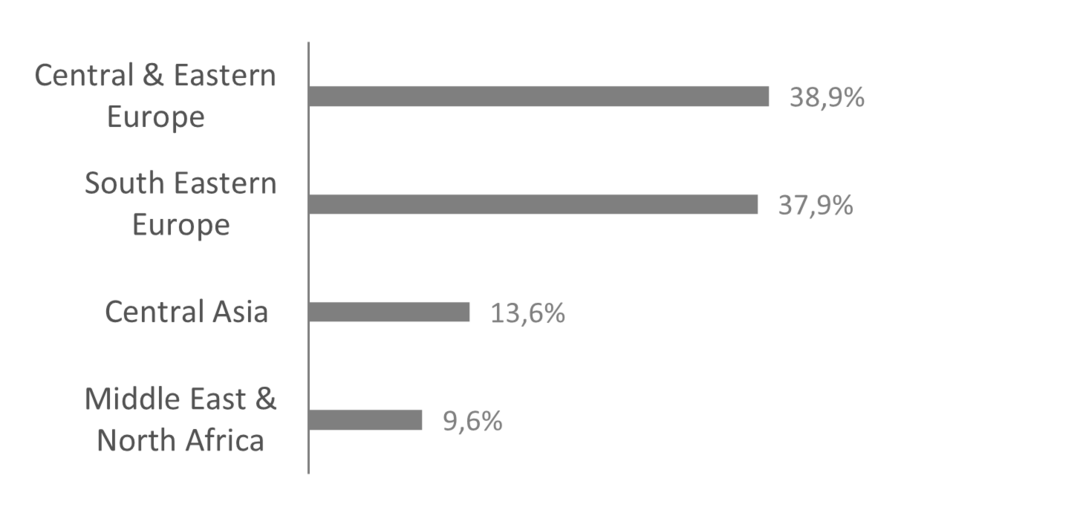

Our ambition is to achieve above-average long-term investment performance through the disciplined application of a value investing approach. In this context, we will invest in equities and occasionally debt securities of Eastern European and Central Asian issuers, which will be selected based on rigorous and independent fundamental analysis.

We view Eastern Europe and Central Asia as an interesting sub-segment of the global equity market. The confluence of favorable top-down factors and a market environment that appears promising for a fundamentals-driven active investment style offers attractive investment opportunities with compelling risk-adjusted return potential.

From a macroeconomic perspective, we invest in one of the world's fastest-growing economic clusters. At the same time, the region's equity market valuation is well below the historical average and appears attractive in both absolute and relative terms compared with many other global markets.

For a large number of investors, the equity markets of Eastern Europe have taken a back seat due to their underperformance since the financial crisis of 2008/2009. With declining investor interest, investment banks have also reduced their equity research capacities allocated to the region. In our view, both aspects have contributed to the emergence of a market environment that is on the one hand defined by less competition from other investors and on the other hand by a higher degree of market inefficiencies.

Therefore, we think that the region's equity market structure and environment increase the potential for spotting undervalued stocks, leading to a promising setup for an active manager to add value via discretionary selection.

Investment principles

While we are valuation-conscious, we don't put emphasis on style-box thinking or the value-growth dichotomy. The concept of value is multi-faceted with growth being a critical part of it.

We might identify value in many different forms and situations, but the unifying principle is to acquire a stock at a substantial discount to a conservative estimate of the underlying intrinsic value. This principle is underpinned by the fact that for a stock to be considered as an investment candidate, an expected 5-year return potential of at least 15% per year and a margin of safety of at least 30% are required.

As a cornerstone of our portfolio, we seek to acquire stocks of good businesses that can compound underlying fundamental value over time. Special situations and "deep value" stocks will complement the portfolio to varying degrees.

We are convinced that it is difficult to achieve above-average returns over the long term if your actions do not set you apart from the crowd. As a sign of this, our investment research process is characterized by intellectual independence. In addition, we focus on market segments that are temporarily out of favor due to size constraints (SMID caps), lack of analyst coverage, or obvious, but fixable, issues, and thus can often be acquired at attractive valuation discounts.

In addition, we seek to operate free of typical institutional constraints, which allows us to apply time horizon arbitrage and achieve above-average portfolio concentration in the most promising risk-adjusted investment opportunities. In our view, incorporating both concepts enhance the potential for superior long-term investment performance.

As the investment strategy is predominantly implemented in an emerging market environment, we consider a minimum portfolio breadth of 20-30 stocks necessary to ensure a sufficient level of diversification in the context of increased systematic risk.

Legal notice: The content of this website does not constitute an offer or an invitation to submit an offer to purchase units of Lacuna Eastern Europe. Purchase orders are only executed on the basis of the valid Voluntary Information Document, which is available free of charge from Lacuna Investment-AG TGV, Ziegetsdorfer Str. 109, D-93051 Regensburg, Germany, exclusively for professional and semi-professional investors.

The prices of the units and their returns may go down as well as up. You may not get back the full amount invested.

*Past performance is not a reliable indicator of future performance. The price performance shown does not take into account investor costs such as front-end load and advisory/distribution fees. Exchange rate fluctuations may affect the values of foreign investments.

Please consult your financial adviser before deciding to invest. The information contained in this website is provided to you for explanatory purposes only. Lacuna GmbH only publishes product-related information and does not make any investment recommendations.