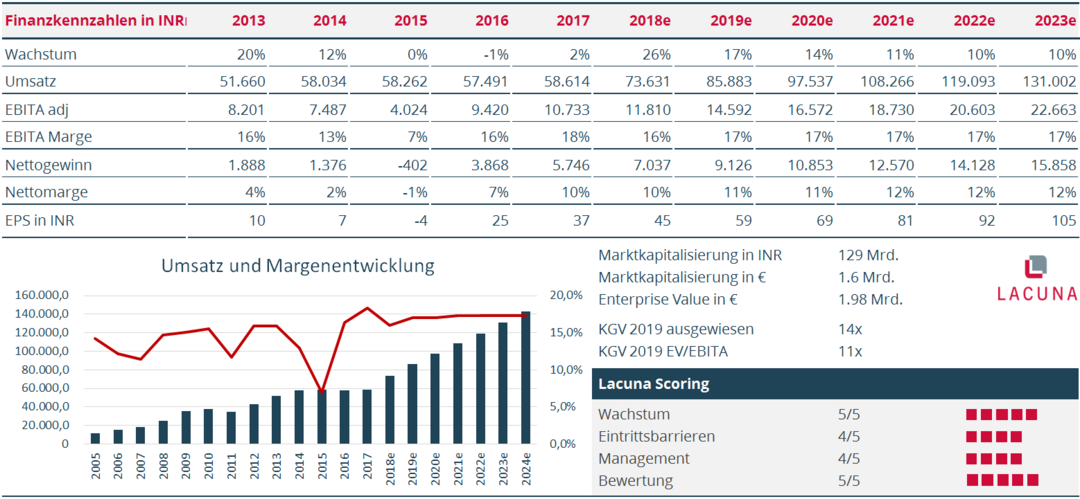

April 2018

Jubilant Life Sciences Limited (“Jubilant” or “the company”), is an Indian specialty pharma and chemical business with a dominant position in a niche market. About 72% of its operating profits are contributed by its higher margin and fast-growing (mid-teens 5y CAGR) pharma business while the remaining 28% stem from the company’s legacy chemicals business. The key growth and profit drivers within the pharma business are radiopharma, injectables contract manufacturing, and orphan drugs (collectively “specialty pharma”).

Dominant Market Position

Jubilant is the market leader in both niche radiopharma and chemicals (pyridine, picoline, Vitamin B-3). The radiopharma business is highly profitable and grows >20% p.a. in the US, Jubilant’s key market. The company also has a near-monopoly in the radiopharma business.

Jubilant’s injectables contract manufacturing facility in the US is a top-five global facility that works with a lot of innovators. It has a well-filled order-book that provides growth predictability for the next 3-5 years.

Our assessment is that the company has a strong moat around its specialty pharma business with FDA approved facilities.

Furthermore, a new competitor would face severe manufacturing, regulatory, and commercial hurdles given the complexity and specialization required in Jubilant’s business segments. In addition to its small market size, the sector is quite unattractive for larger pharma players. These factors will likely protect Jubilant’s business prospects for a long time.

Even if we do not project any margin expansion and multiple re-rating, our opinion is that the underlying business will still provide good returns.

The Opportunity

After June 2015, Jubilant has recovered from its previous 3-year rough patch of regulatory and financial issues. While the stock has performed well since it hit its multi-year low in 2013/2014, we still view this as a buying opportunity. Our investment thesis is:

- Long-term compounder expected to grow >11% 5y CAGR, generating high-teens post-tax ROTCE

- Potential for margin improvements through an improving product mix and increasing utilization of the injectables contract manufacturing facilities

- Strong-moat business, with a dominant market share in niche pharma with strong pricing power

- Capable management with high integrity and “skin in the game” (52% of shares outstanding)

- Reasonable valuation at 11x forward EV/EBITA or 14x P/E (Indian pharma companies trade at high-teens P/E)

- Recent acquisition of the 2nd largest radiopharma distributor in the US (at a steal!) deepens Jubilant’s moat and reflects sound capital allocation focused on long-term growth

- Potential for value-unlocking/re-rating once the pharma business is listed separately

Right Track after Key Transformational Initiatives

The management has made changes based on lessons from earlier experiences and their new initiatives are yielding results:

- Intensifying focus on specialty pharma, since it’s Jubilant’s strength and has a higher margin and better potential for growth

- Retrofitting idle facilities (from chemicals) to use for their fast-growing specialty pharma

- Diversifying the chemical business into newer Asian export markets (and thereby reducing damage from China after their anti-dumping duties)

- Acting cautious on expanding chemical capacities, which is believed to have contributed in dragging down prices historically (given Jubilant is a dominant player)

- Committed to bringing down their debt

Summary

Jubilant fits our investment criteria of a business with strong barriers to entry, pricing power, and capable management. We think that Jubilant is often misunderstood as a chemical business only which in reality contributes less than 30% of the company’s profits. This provides us with an opportunity to buy a long-term compounder at a reasonable valuation at 11x EV/EBITA. Management’s plan to separately list the pharma business in India/Singapore is an additional upside catalyst which will likely release value.