August 2018

Shire Plc is a UK listed diversified specialty pharma and rare disease company with dominant position in niche markets. 67% of its revenues come from US and the remaining third from Europe and Japan.

About 60% of its topline are contributed by its rare disease and plasma businesses including hematology/hemophilia, immunology, and genetic diseases. With the life threatening characteristics of these diseases, Shire enjoys customer loyalty and strong pricing power. The remaining 40% of Shire’s business is contributed by neuroscience (attention deficit hyperactivity disorder or “ADHD”), gastrointestinal and ophthalmology.

Hidden Assets of a Global Player

Shire is an innovative company with a strong pipeline. It is amongst the top 3 players globally in most of its segments. Our assessment is that the company has a strong moat around its businesses with its dominant position in niche segments, customer retention and strong pricing power.

Shire's immunology/plasma business is growing double digits due to a strong oligopoly, high barriers to entry and strong demand globally. This valuable asset seems to be overlooked by the market, as it is hidden in Shire’s large diversified organization.

A new competitor would face severe manufacturing, regulatory and commercial hurdles given the complexity and specialization required in Shire’s niche therapies. That said, Shire’s diverse rare disease portfolio and manifold pipeline is also more resilient to patent cliffs, and to typical pricing pressure from generic drugs, both of which have been a headwind for many major pharma companies.

The Dive in Share Prices

We started looking at Shire in the fourth quarter of 2017. Shire’s share price was falling off a cliff during that period due to over-blown concerns with respect to near-term supply issues and competition. In addition, Shire’s sizeable leverage worsened investor sentiments. However, we still saw a good investment opportunity in Shire due to the following reasons:

- Shire is a dominant player in rare diseases/plasma trading at massive discount to peer

- Over 50% marginal return on tangible capital (ROTCE) business trading at single-digit forward p/e multiples

- Solid future cash flows to help reduce the debt load without any equity dilution

- A diverse portfolio and strong pipeline that can better withstand any product specific risks

- Potential for value-unlocking/re-rating once the neuroscience/ADHD business (which has different economics and growth trajectory) is carved out or spun off from the wider moat rare diseases/plasma business

- Sustainable long-term mid-single digit organic growth driven by geographical and product expansion

Takeda Merger as Investment Boost

In March 2018, Japan’s Takeda announced to acquire Shire at a 50% premium. While this was not part of our original investment thesis, it helped change investor sentiments and re-rate Shire much sooner than we had anticipated. We benefitted massively from this news given Shire was one of our biggest holdings.

While following Shire’s re-rating after the M&A news, Shire is not “massively” undervalued now. We still hold Shire as we see double-digit returns from the business over a long run – whether it runs as a standalone entity or part of Takeda.

That said, there is always a small risk that the Takeda deal falls apart if not approved by shareholders of Shire or Takeda. The stock might dip temporarily upon such an event. However, given the long-term fundamentals of the company remain intact, our original investment theses still hold.

Strides has a leveraged balance sheet at (4x Net Debt/2019 EBITDA) which may initially seem alarming, but our view is that the leverage ratio appears high as the 2019 EBITDA was impacted by one-time issues in the US. We believe that these business challenges are temporary as the EBITDA is expected to grow by 30% by 2020 and not significantly impair our long term intrinsic value of the business.

Summary

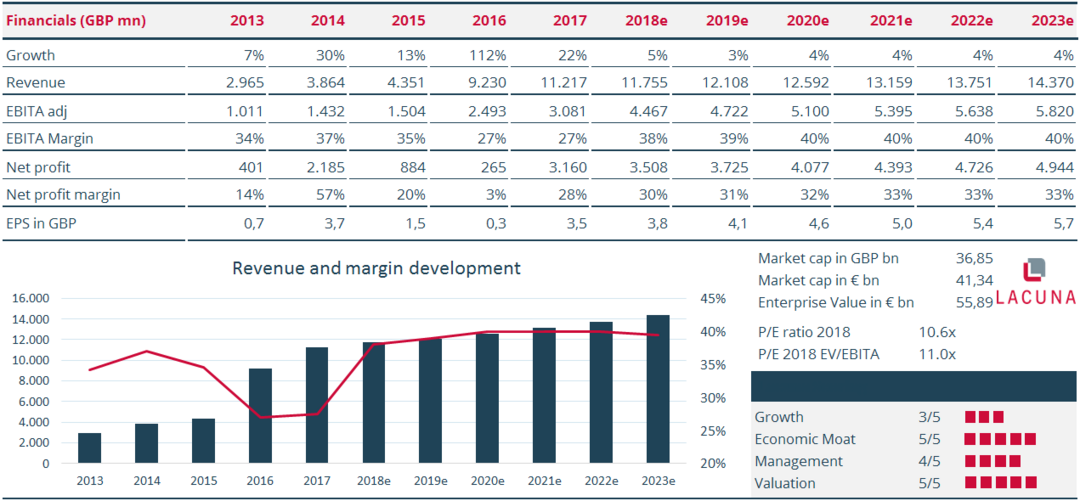

Shire fits our investment criteria of a business with a dominant position in niche pharma, strong barriers to entry and customer stickiness. Our view is that at 11x p/e, Shire still remains undervalued for a business generating marginal return on tangible capital of over 50%. Since our long-term investment philosophy isn’t influenced by short-term lows, but also we don’t jump onto short-term merger arbitrage. Instead we stick to our value investment strategy and try and evaluate the intrinsic value of Shire based on its fundamentals.